136 137

28.

Accounting classifications and fair value (continued)

(c)

Fair value measurements (continued)

(i)

Assets and liabilities measured at fair value (continued)

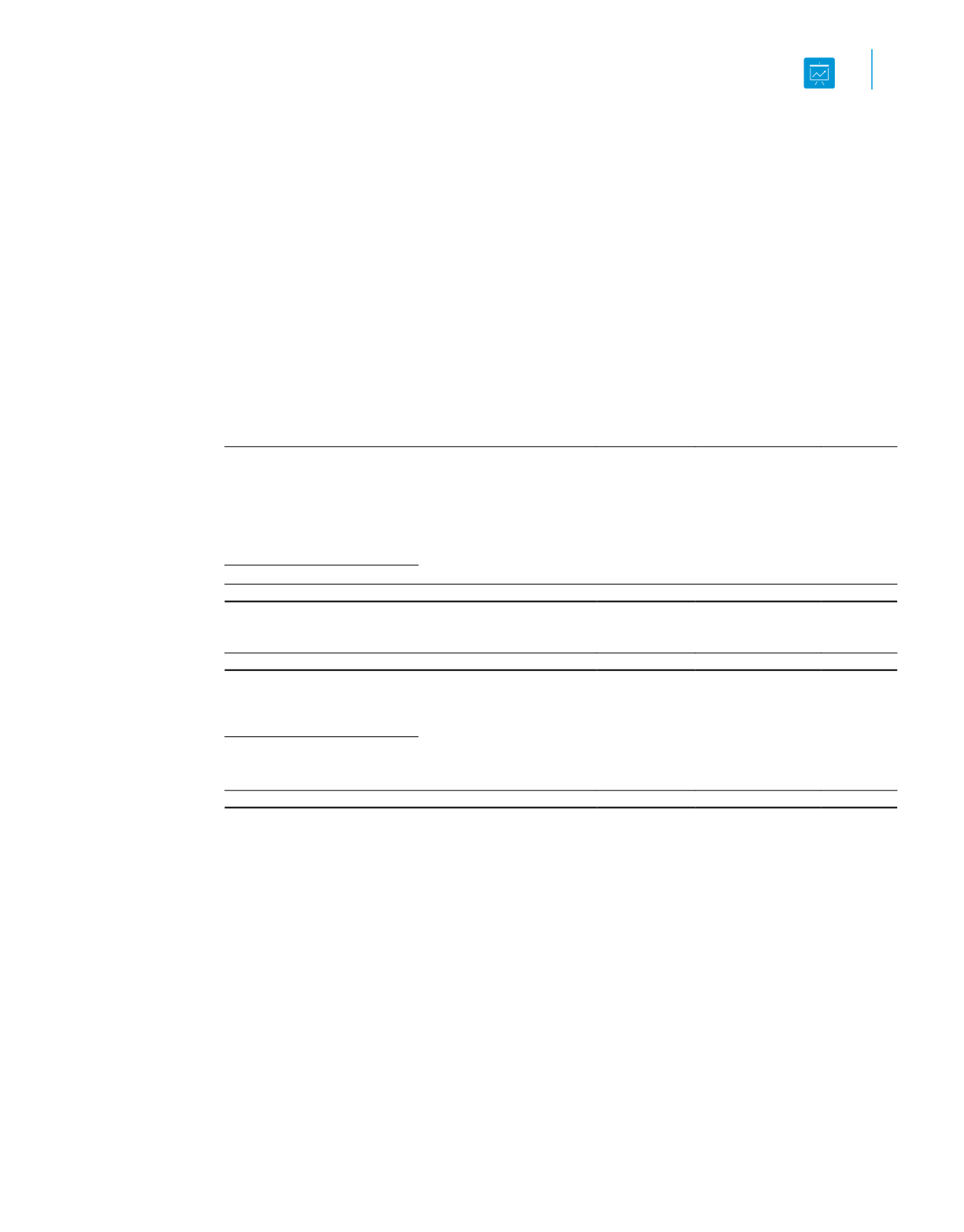

Significant

Observable

Inputs Other

Than Quoted

Prices

Significant

Unobservable

Inputs

Group

(Level 2)

(Level 3)

Total

$’000

$’000

$’000

2014

Recurring Fair Value Measurements

Assets

Financial assets:

Derivative financial instruments

– Currency swaps

18,148

–

18,148

Total financial assets

18,148

–

18,148

Non-Financial Assets:

Investment properties

–

869,085

869,085

Total non-financial assets

–

869,085

869,085

Liabilities

Financial liabilities:

Derivative financial instruments

– Currency forwards

916

–

916

– Currency swaps

1,736

–

1,736

– Interest rate swaps

514

–

514

Total financial liabilities

3,166

–

3,166

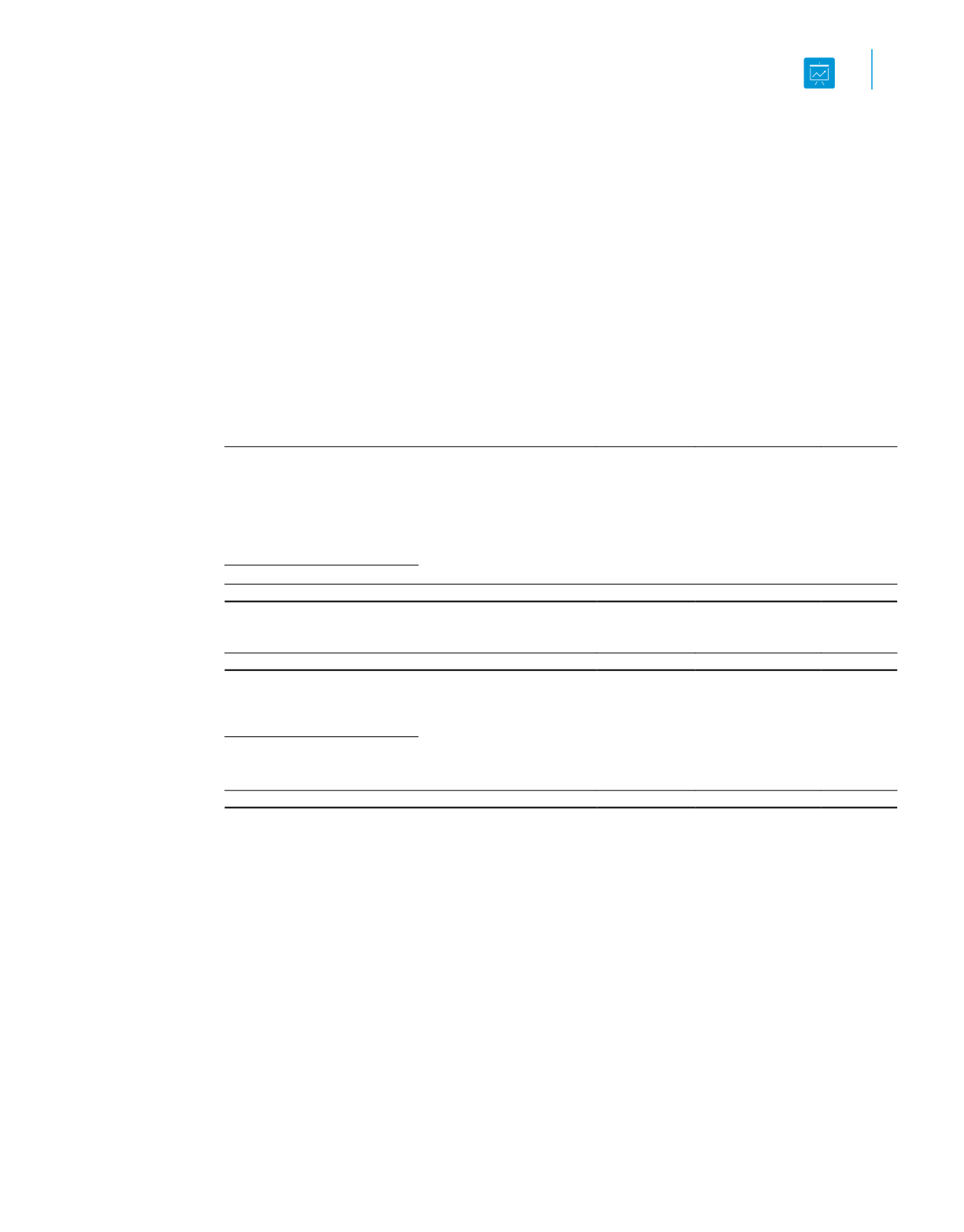

(ii)

Level 2 fair value measurements

As at 31 March 2015, the Group has currency forwards, interest rate swaps and currency swaps, which are

categorised in Level 2. The fair value of currency forwards is determined using mark-to-market valuation,

which is calculated on the basis of quoted forward exchange rates at the balance sheet date, received from

respective banking and financial institutions. The fair values of interest rate swaps and currency swaps are also

determined using mark-to-market valuation, which is calculated as the present value of the estimated future

cash flows, received from respective banking and financial institutions. These derivative financial instruments

are recognised at fair value in the financial statements.